While many industries have been disrupted by the recent wave of U.S. chemical tariffs, others have seen it as a catalyst for bold transformation. In this week’s case study, we examine how forward-thinking companies are thriving—not just surviving—by investing in domestic chemical manufacturing and reshaping the supply chain.

These organizations are turning policy headwinds into innovation tailwinds. Their stories are proof that strategic localization, sustainability, and profitability can coexist.

The Tariff Shift: Why Reshoring Makes Sense

The 25% tariffs imposed on chemical imports from countries like China, Canada, and Mexico have made foreign sourcing more expensive and less reliable. As a result, many chemical companies are making the long-overdue decision to reshore production.

By focusing on domestic chemical manufacturing, companies gain:

- Greater control over supply chains

- Shorter lead times and improved delivery reliability

- Avoidance of costly international duties

- Alignment with U.S. sustainability and trade policies

The current trade environment offers a rare opportunity to invest in American manufacturing while enhancing environmental and operational resilience.

Case Study 1: Johnson & Johnson’s $5.5 Billion U.S. Expansion

In March 2025, Johnson & Johnson announced a sweeping $5.5 billion plan to expand its U.S. operations over the next four years. This includes the development of new manufacturing sites for chemical inputs, intermediates, and pharmaceuticals.

Their decision was directly tied to avoiding geopolitical uncertainty and ensuring long-term product reliability.

Key Results:

- Projected 10,000+ new domestic jobs

- Investment in local R&D and formulation labs

- Reduced exposure to volatile overseas markets

Case Study 2: Eli Lilly’s Multi-Billion Dollar Bet on U.S. Manufacturing

Around the same time, Eli Lilly committed $2.7 billion to build four new plants in the United States. These facilities will produce raw chemical ingredients, serving both domestic and global markets.

Key Drivers:

- Access to a stable energy supply

- Rising shipping costs and delays from international partners

- U.S. tax credits and incentives for manufacturing investments

Impact:

- Strengthened U.S. pharma and specialty chemical value chains

- Onshored jobs that were once overseas

- Better integration with domestic logistics and customer networks

The Ripple Effect: How Smaller Players Benefit

These major moves set a precedent for smaller chemical companies to follow. With increasing support from federal and state programs, mid-sized manufacturers can:

- Retrofit facilities for reuse and sustainability

- Apply for reshoring tax incentives

- Participate in domestic supply hubs

Companies in niche chemical sectors—such as coatings, cleaners, petrochemical byproducts, and fuel additives—stand to benefit by offering locally sourced, tariff-free alternatives.

What’s Driving the Shift to Domestic Chemical Manufacturing?

- Tariffs and Geopolitical Risk: Tariffs increase costs and uncertainty, making overseas reliance risky.

- Incentives for U.S. Investment: Government policies are rewarding onshoring with grants, tax breaks, and R&D funding.

- Consumer & Customer Expectations: ESG and traceability are driving demand for locally sourced materials.

- Innovation Hubs: Domestic manufacturers now have access to advanced R&D through public-private partnerships and academic institutions.

Explore more about how Altiras supports reshoring through reuse and testing services.

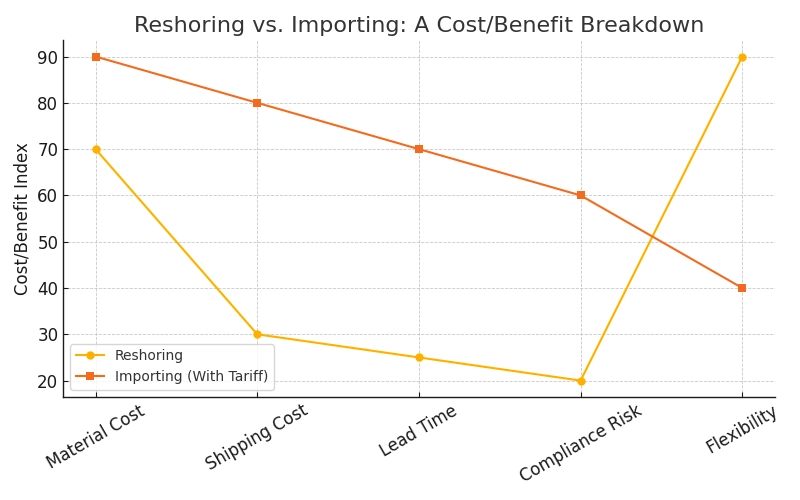

Chart: Reshoring vs. Importing — A Cost/Benefit Breakdown

| Cost Factor | Reshoring (U.S.) | Importing (With Tariff) |

| Material Cost | Medium | High |

| Shipping & Logistics | Low | High |

| Lead Time | Short | Long |

| Compliance Risk | Low | Medium to High |

| Overall Flexibility | High | Low |

Conclusion

The U.S. chemical industry is undergoing a transformation, and those embracing domestic chemical manufacturing are leading the way. Companies that adapt to the new economic landscape by investing in local facilities, leveraging co-product reuse, and aligning with sustainability goals will be best positioned for long-term success. Altiras is ready to support your reshoring goals—through chemical reuse strategies, testing services, and sustainable feedstock sourcing. Learn more about our beneficial reuse programs and how they fit within today’s U.S.-first approach.