At first glance, tariffs can seem like nothing more than an economic roadblock. But when viewed through a strategic lens, they can be a powerful incentive for reshoring, innovation, and long-term sustainability. In this final installment of our campaign, we look at how the U.S. chemical industry can turn current challenges into catalysts for a stronger, more sustainable U.S. chemical manufacturing sector.

Reframing the Tariff Conversation

The recent tariffs on imported chemicals have driven up costs for foreign-sourced materials—but they’ve also encouraged a renewed focus on domestic production and innovation. According to S&P Global, many petrochemical companies report little long-term disruption and see opportunity in building resilient, domestic operations.

How Tariffs Promote Long-Term Sustainability

- Localized Manufacturing Reduces Emissions

Sourcing and producing chemicals locally eliminates the carbon footprint from ocean freight and long-haul international trucking. - Increased Investment in Cleaner Technologies

Companies reshoring operations are building with advanced, energy-efficient infrastructure that aligns with ESG goals. - Greater Adoption of Reuse and Recycling

Tariff pressure makes beneficial reuse and chemical recycling more attractive from a cost standpoint, which supports environmental goals. - Resilience in Global Disruptions

Domestic infrastructure is less vulnerable to geopolitical risk, port congestion, and cross-border regulation changes.

Long-Term Industry Shifts

- Capital Investment Growth: Billions are being poured into new U.S.-based chemical and fuel production facilities.

- Job Creation: Domestic plants create skilled labor opportunities in engineering, research, and operations.

- Circular Economy Integration: More companies are implementing closed-loop reuse systems, minimizing waste and maximizing value.

Beckway outlines that companies using this period to rethink supply chain and sourcing strategy are better positioned for long-term resilience.

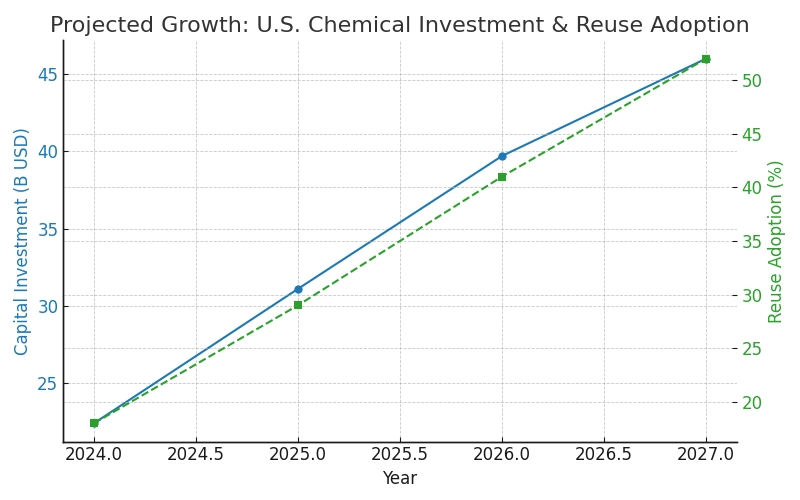

Chart: Projected Chemical Sector Growth Post-Tariffs

| Year | U.S. Capital Investment ($B) | % Growth in Beneficial Reuse Adoption |

| 2024 | $22.4 | 18% |

| 2025 | $31.1 | 29% |

| 2026 | $39.7 | 41% |

| 2027 | $46.0 | 52% |

Infographic: Tariff Timeline of Positive Impact

- Year 1: Tariff shock and price hikes

- Year 2: Reshoring and investment begin

- Year 3: Beneficial reuse scales up

- Year 4: Domestic value chains stabilize

- Year 5: Industry gains independence and lowers emissions

How Altiras Helps Build a More Sustainable Chemical Industry

Altiras supports companies in:

- Replacing imports with reused or reclaimed chemical streams

- Designing and testing beneficial reuse programs

- Implementing circular solutions that cut costs and emissions

Whether you’re transitioning to localized sourcing or adopting chemical recycling and reuse, we have the infrastructure, labs, and know-how to help. Learn more about our beneficial reuse services and sustainable solutions.

Conclusion

Tariffs are more than just policy—they’re a signal. They’re prompting a shift toward independence, sustainability, and smarter use of resources. Companies that embrace this transformation will not only protect their bottom line but help shape the future of sustainable U.S. chemical manufacturing.

Thank you for joining us on this 6-week journey. For additional insights, contact Altiras to explore how we can support your transition to a stronger, more sustainable future.